Import Export Code is a ten-digit unique code assigned to an individual/company and is required for every import/export operation. The first step in expanding a business abroad is to export and import products & services. Trading not only helps the business personnel individually but also provide benefits to the Country as well. The government has prioritized trade facilitation in order to reduce transaction costs and time.

The various provisions of the Foreign Trade Policy and measures taken by the government in the direction of trade facilitation have been consolidated for the purpose of import and export trade. The most important aspect of a company's success is growth. Expansion of business globally could be the very first step towards this. Import Export Code Renewal every year is mandatory now for IEC License holders. Once import export code is issued, exporters can apply for port registration on icegate portal with the help of AD Code registration.

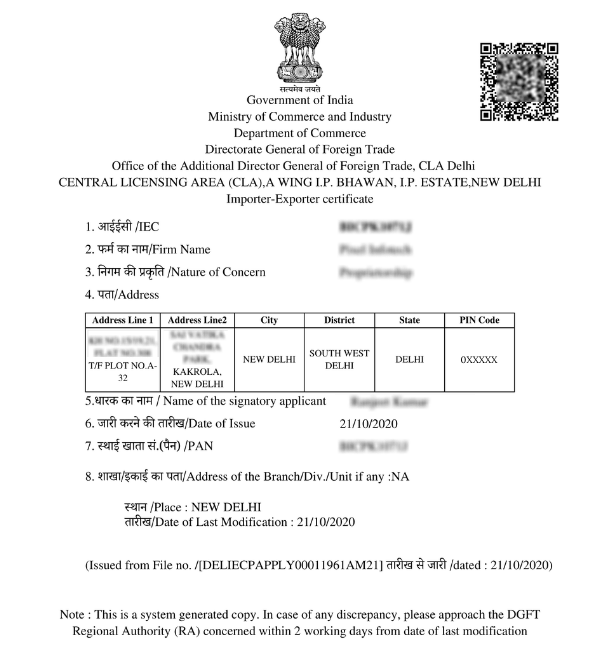

IEC Certificate Sample

Import Export Code is a ten-digit unique code assigned to an individual/company and is required for every import/export operation. The DGFT is in charge of issuing import export codes. DGFT stands for Director General of Foreign Trade. Importer Exporter Code is the full form of IEC, although it is more commonly known as import export code.

Unlike other government licenses, the Import Export Code does not need to be renewed on a regular basis. However, one needs to update the status of IEC license on dgft portal on a yearly basis.

Since discussion about business can’t be completed without mentioning the profit and the loss. Our focus is to provide legal benefit to your business, so we would be taking the profit portion forward. The government has made trade facilitation a priority in order to minimize transaction costs and time, making Indian exports more competitive. For the benefit of import and export trade, the various provisions of the Foreign Trade Policy and steps taken by the government in the direction of trade facilitation are consolidated.

Want to know how IEC could be useful for your business? Let’s have a look how IEC can help you as an exporter or importer:

Import Export Code provides you the facility to expand your business over foreign countries. The basic and most important thing you would need while trading oversea is the Importer Exporter Code. IEC opens your road to expansion and growth on foreign lands.

The code provides you the license to export your goods and services to any other country and to import the essentials of your business to your own country. It makes your trade over cross borders easy and legal.

Now Obtaining IEC could be avail at the ease of sitting home. If you provide accurate and all documents then you could have it at your home. The need to hustle to the government office will not come into the way.

The government offers benefits such as export subsidies and excise tax concessions in case of import. If the import is completed within the specified time period, some tax relief might be available. In the case of exports, the government offers a subsidy on all the exports taxes. These advantages are only available to those who are enrolled with the IEC.

The importer's IEC Code must be declared to Customs, and the Bill of Lading must reflect this. All bills of lading for cargo destined for or trans-shipped through Indian ports must include the Indian consignee's IEC Code.

EFT (Electronic Fund Transfer) is a new service offered to exporters that allows them to submit their license fee via the Internet rather than visiting a bank to make the payment. This procedure is being proposed to make electronic payments more convenient. Only electronically filed applications will be accepted.

Before proceeding to the process of Registration lets have information regarding the documents needed to get Import Export Code License Online in India. The nature of the firm obtaining an IEC may be any of the follows- "Sole Proprietorship, Partnership, LLP, Private Limited Company & Public Limited Company, Trust, HUF and Society."

The documents that would be required are as follows:

(3).png)

The Government fees for Import export code(IEC License) registration is ₹500. The professional fees for IEC code Registration is ₹999. Hence, the Total cost of getting an IEC certificate will be ₹1499 (₹500 + ₹999). There are no other charges involved in IEC code registration.

| IEC Registration Fees | |

|---|---|

| Aayaat Niryaat Form no. 2A | NIL |

| Filing at DGFT | NIL |

| Professional Fees | Rs. 999 |

| Govt. Fees | Rs. 500 |

| Rs. 1,499 Only/- | |

Note: The aforementioned Fees is exclusive of GST.

You can get an Import Export License online as well as offline. For applying online one must be aware of the process of obtaining IEC code. The overall process is breakdowned into five major steps. Let’s know about them in detail:

The very first step for obtaining an Import Export License online is the registration part. One can register online through the government portal of DGFT.

The very next step after registration is the applying phase. All the documents are arranged and prepared for application. You may already know about all the documents required for an IEC application online as we have discussed earlier.

The next step combines the form filling along with the documents uploading.The “ANF2A” (Aayat Niryat Form 2A) is required to fill along with all the necessary documents attached.

After submission of your application form, it is sent to the DGFT for verification of the documents. Your application may get approved or rejected based on the documents you have uploaded. So one must be very careful regarding the documents they need to upload.

This is the final step of obtaining your Import Export Code. Once your IEC application is approved by DGFT, your Import Export Code would be issued to you. In case of online application you will get e-IEC, once approved by competent authority. You will be informed through email that your e-IEC is available on DGFT website.

Unlike other government licenses, the Import Export Code earlier was not needed to renew on a regular basis. However, after the amendments in Import Export Code related provisions under Chapter 1 and 2 of Foreign Trade Policy on 12th February, 2021 Import Export Code now has to be renewed each and every year. This amendment made the update of IEC code details mandatory for all IEC or e-IEC holders on DGFT portal each year. Even if there are no updates in IEC, the same has to be confirmed online

You need more than just an Import Export Code to operate an export business in india. Although the IE Code is a necessary for beginning export operations, having one is not sufficient. There are other mandatory documents and registrations in place to get going.

The requirements depend on the type of product you are exporting. There are Export Promotion councils for each commodity and you must obtain registration for each commodities you want to export.

For Example - If you are a Spices exporter, you must obtain a Spice Board Registration to export spices from India . Similarly, Tea Board Registration and Coffee Board registration are required for exporting Tea and coffee, respectively.

There are several other Export Promotion Councils like APEDA, Rubber Board, MPEDA, TEXPROCIL, CAPEXIL and so on. Apart from that, AD code Registration is required for Foreign transactions and Customs clearance at ports.

The complications in understanding the process and providing appropriate documents are very much hectic. The chances of application rejection are very much high at each and every step of documents uploading. There are different formats of Digital Signature Certificate that one must upload depending on their criteria. Help from the experts are advised to ease the process of IEC application. You can apply for IEC with just three simple steps with us.

Step 1:

Get in touch via call or contact form

Step 2:

Provide necessary documents

Step 3:

Get your IEC registered in 3-4 days

At Liquetax, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

There are few steps that you have to follow :

Import Export Code or IEC is a 10-digit code that a business or a person needs to import/export goods/services. This code is issued by DGFT (Director General of Foreign trade), Ministry of Commerce and Industries, Government of India. The validity of this code is for lifetime, that is, there is no need to renew it. This code is generated within 5-15 working days after the documents are submitted and all the corrections required are made

We take 4-5 working days to process the IEC code for you/your firm.

The DGFT introduced the Digital Signature Certificate (DSC) to make the issuance and registration process more secure. The certificate should be of either Class-2 or Class-3 and issued only by CCA approved certifying agencies in India.

Yes you can. You need to inform the issuing authority about such a decision. And they shall immediately cancel your IEC number after electronically transmitting it to DGFT for onward transmission to the Customs and Regional Authorities.

If your business is registered under GST, then the PAN number can be used as the IEC code.

Normal procedure is followed to obtain IEC code in case of NRIs. In some exceptional cases, the permission from RBI/FIPB is required.

After the amendments in Import Export Code related provisions under Chapter 1 and 2 of Foreign Trade Policy on 12th February, 2021 Import Export Code now has to be renewed each and every year. This amendment made the update of IEC code details mandatory for all IEC or e-IEC holders on DGFT portal each year. Even if there are no updates in IEC, the same has to be confirmed online.